Most people think budgeting is only for those trying to save money — but here’s the truth: even billionaires budget. They don’t just focus on earning more, they focus on managing what they already have. That’s how real wealth grows.

In 2025, the smartest and richest people in the world will follow daily money habits that help them stay rich from tracking spending to planning smart investments. And you don’t need to be a millionaire to use these tricks.

Whether you earn $1,000 or $100,000 a month, these strategies can help you keep more money, grow faster, and stay financially stress-free.

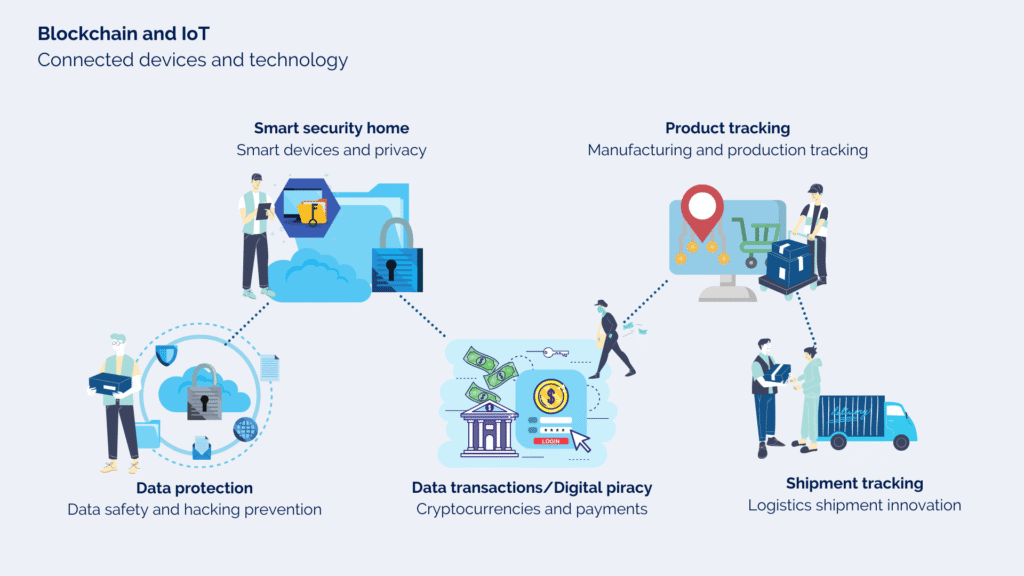

What this blog cover: your 2025 Crypto mining guide.

1. Crypto Mining Profit in 2025: What’s Changing?

2. Smart Tech & New Strategies: How Crypto Mining Is Evolving in 2025?

3. Going Green: How Crypto Mining Is Becoming Eco-Friendly in 2025?

4. Crypto Laws & Big Investors: What’s Changing in 2025?

5. Crypto Mining’s Impact on Communities in 2025?

Conclusion: The Future of Crypto Mining in 2025.

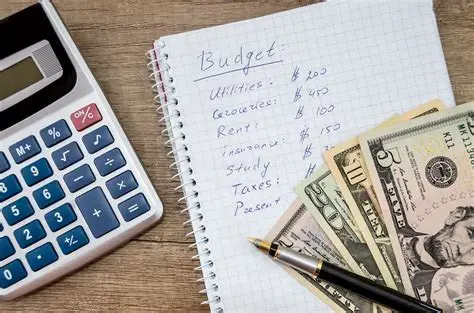

1. Billionaires Use Budgeting as a Smart Strategy — Not a Limitation.

Most people think budgeting means cutting back or saying “no” to fun. But the ultra-rich think differently. For them, budgeting is a smart money strategy, not a sacrifice.

Take Warren Buffett, for example — he lives a simple life, even though he’s one of the richest people on Earth. Why? Because he sees money as a tool to grow wealth, not something to show off.

Billionaire mindset “Where can my money work the hardest today?”

Start thinking of your budget as a way to grow your money, not just save it. Every dollar should go toward something that gives you value — whether it’s investing, building a skill, or starting a side hustle.

2. They Begin Each Day by Checking Their Finances.

Many billionaires and top CEOs start their morning by taking a quick look at their money — just like checking the weather or reading the news. They review things like their net worth, investment updates, business income, and even their spending the day before.

Why do they do this? Because if something doesn’t look right, they want to fix it fast. It’s like checking your health. You notice small changes before they become big problems.

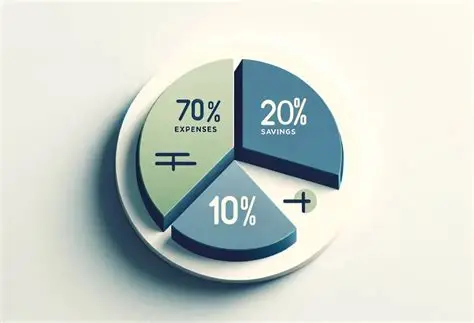

3. They Follow Smart Money Rules – Like 70/20/10 — or Even Better.

Wealthy people often use a simple money formula to manage their income wisely. One popular method is the 70/20/10 rule.

- 70% for daily living

- 20% for investments

- 10% for giving to charity

But billionaires often flip the script. They might spend just 10% on lifestyle, keep 30% for business or savings, and put 60% into investments or long-term goals. Their focus is not just on comfort now — it’s on building wealth for the future.

Try this: If you’re just starting, use the simple 50/30/20 rule (needs/wants/savings). As your income grows, adjust the numbers to invest more.

4. They Give Every Dollar a Purpose.

Billionaires don’t let their money sit around with no plan. Every dollar they earn has a job whether it’s for investing, donating, growing their business, or saving for taxes. To them, idle money is wasted money.

One common saying in wealth circles is Unassigned money is usually spent badly. That’s why many wealthy people use separate accounts or digital wallets for their different goals like business growth, tax savings, or emergency funds.

5. Them Automate Their Wealth Building.

Billionaires don’t leave their financial growth to chance — they automate it. Things like retirement savings, tax payments, investments, and charity donations are all scheduled to happen on their own.

Why? Because automation takes out stress and excuses. Their money grows without needing daily decisions or effort.

You can do the same. Start small by setting up auto-debits for:

- SIPs (Mutual Funds).

- Crypto DCA (Dollar-Cost Averaging).

- Business expenses.

- Retirement plans like NPS or IRAs.

6. They Do a Full Financial Review Every Month.

While many billionaires check their money daily, they also take time each month to do a deep financial review. This helps them stay on track and improve how they manage their wealth. They look at questions like: Where did my money go this month? What worked? What didn’t? Can I cut waste? Should I invest more in something that’s growing?

Some even meet with their financial advisors or CFOs regularly. You can do the same by reviewing your budget and spending using a simple tool like Google Sheets or apps like Tiller Money.

7. They plan their day like they plan their money.

For billionaires, time is just as valuable as money. That’s why they plan their daily schedule carefully to get the most out of every hour. Their day might start at 6:00 AM with a workout, followed by reading or meditation at 7:00 AM, and business or money-making work at 8:00 AM. They know exactly how they’re spending their time — and they cut out anything that doesn’t bring results or value.

8. They Keep Track of Every Expense — Big or Small.

Even the richest people track their spending carefully. They keep an eye on travel expenses, business costs, and even family lifestyle spending. It’s not because they’re stingy it’s because they want clarity and control. Knowing exactly where money goes helps them make better financial decisions.

9. They Focus on Paying Less in Taxes — Legally.

Billionaires don’t just focus on how much they earn — they focus on how much they keep. They study tax laws and use smart strategies like real estate depreciation, trust funds, offshore accounts, and planning around capital gains taxes. These tools help them save millions over time.

But they always stay within the law. It’s not about tax evasion it’s about tax optimization.

10. They Don’t Let Emotions Control Their Money Decisions.

Billionaires don’t make financial decisions based on fear or excitement. They avoid emotional traps like revenge shopping after a bad day or panic selling when the market dips. Instead, they stick to their long-term money plans and review their goals regularly.

They trust the process and ignore the daily noise of financial news or social media trends.

11. They Always Invest in Learning and Self-Improvement.

Rich people know that knowledge is power. That’s why they set aside time and money to learn new things — whether it’s through online courses, mastermind events, business coaching, or books. Some even spend $10,000 or more attending top-level learning events that sharpen their skills and expand their network.

12. They Involve Their Whole Family in Money Matters.

Wealth isn’t just personal — it’s a family responsibility. Billionaires often hold monthly family finance meetings, teach their children how to budget and invest, and create money rules for future generations.

They believe that wealth should last — not just for them, but for their kids and grandkids too.

Final Thoughts: Budgeting Like the Rich Starts with One Step.

For billionaires, budgeting isn’t about limiting freedom — it’s about how they create it. They use money with a purpose, build smart systems, and make decisions that grow their wealth over time.

The good news? You don’t need millions to start. Whether you earn $1,000 or $100,000 a month, you can use the same habits. All you need are:

- The right mindset

- A simple money system

- A few smart tools to guide you

The LLD Team is here to help you build powerful money habits no matter where you’re starting from.

TRENDING ARTICLE